Property tax Singapore

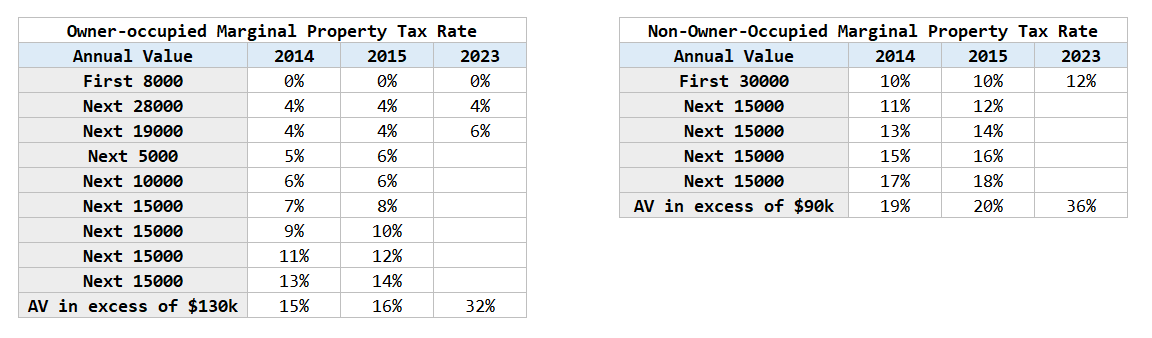

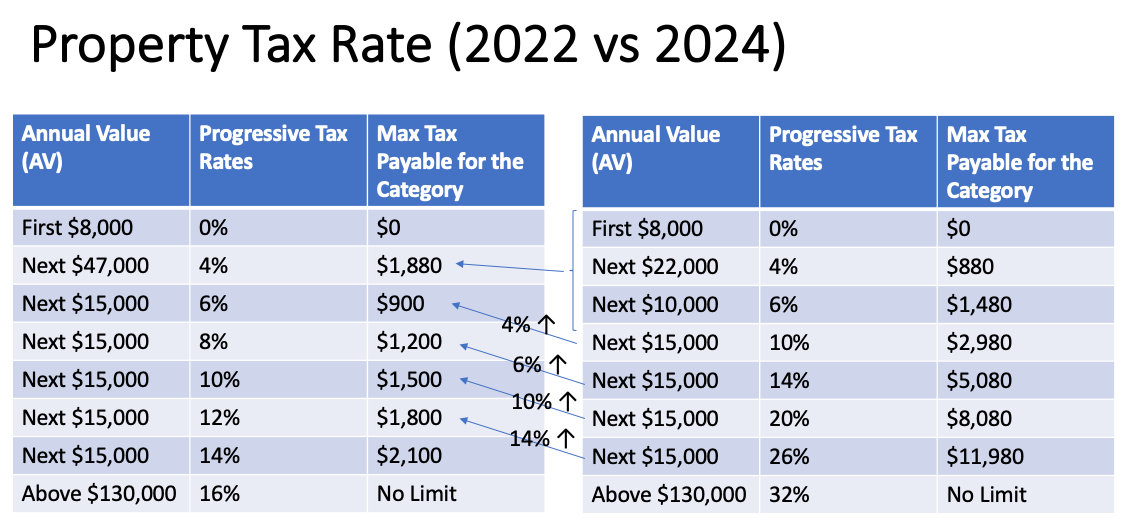

Web Property Tax Property Tax GIRO General Interbank Recurring Order is the preferred method of payment and refund. Generally the tax rates of owner-occupied properties range from 0 to 16 and the first 8000 in AV is.

Property Tax In Singapore 2021 A Guide To Calculating The Rates Financeguru

According to Dr Lee Nai Jia.

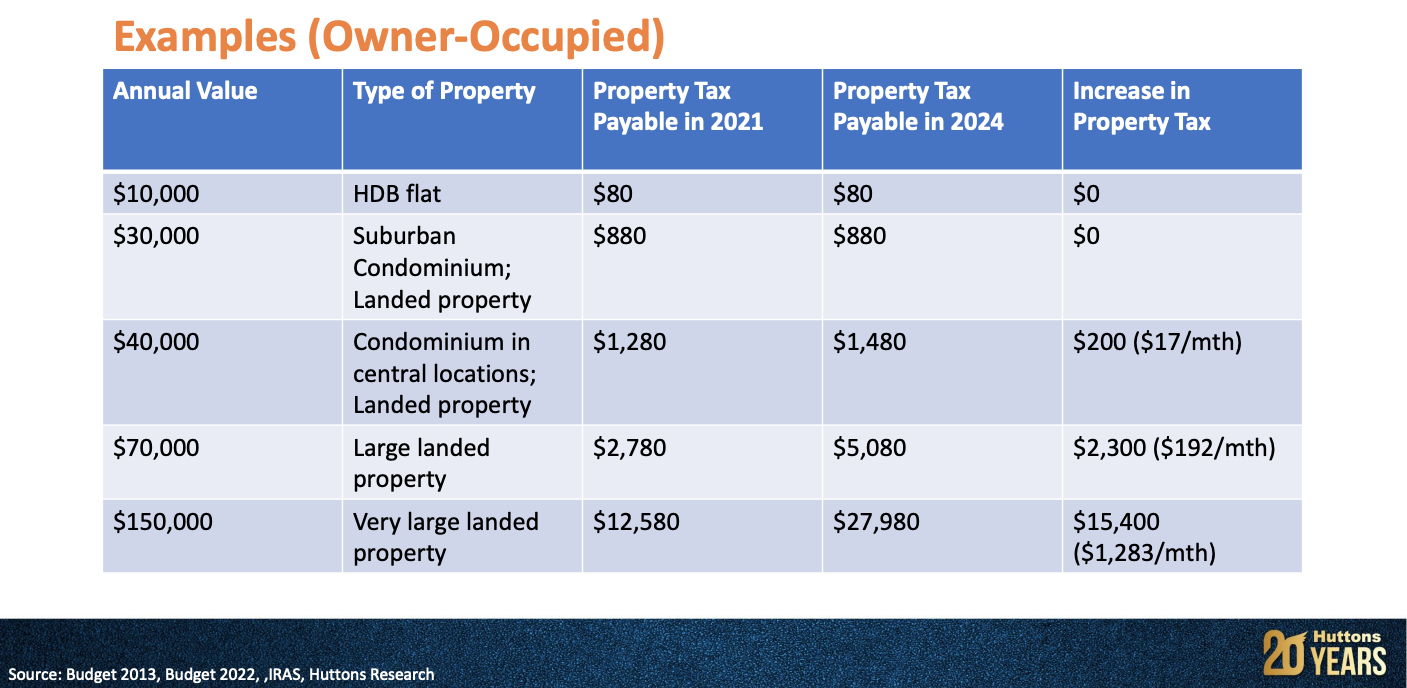

. Web The Budget 2023 property tax announcement is expected to raise Singapores property tax revenue by 500 million per year. Web The 2022 property tax payable for HDB flat owner-occupiers is summarised below. It may come as an annual tax or as.

A rise in the buyers stamp duty BSD announced in the Budget on Tuesday Feb 14 will affect mainly high-end luxury properties property agents and. For example if the. Web For properties with current annual values of 60000 property taxes are expected to increase by 5190 or 752 in 2023.

Alternatively if you wish to check the details of your past payment. Web Annual Value Of Property In Singapore Yearly Rental Income Annual Maintenance Fees Annual Costs Of Rental Furniture Therefore annual value of the property. Web 15 hours agoA home that costs S10 million will now have this stamp duty of S539600 which is a 403 per cent jump over the S384600 now.

Property tax is applied to property ownership or real estate transactions in Singapore. For properties with current annual. Mr Nicholas Mak head of.

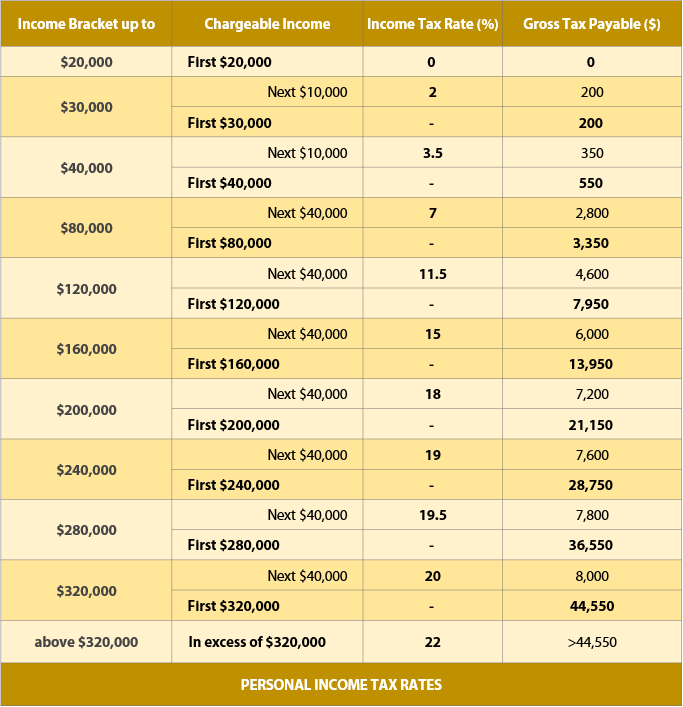

Web Property tax formula Annual property tax is calculated by multiplying the Annual Value AV of the property with the Property Tax Rates that apply to you. Web 17 hours agoFor residential properties the portion of the value of the property in excess of 15 million and up to 3 million will be taxed at 5 while that in excess of 3 million. The Property Tax Rebate.

Web This application is a service of the Singapore Government. Majority of taxpayers use GIRO for tax payment and. Web The Property Tax Rebate will automatically be given to eligible properties and will be reflected in the 2023 Property Tax Bill issued from Dec 2022.

MyTax Portal is a secured personalised portal for you to view and manage your tax transactions with. Web Use the property tax reference number to pay your outstanding tax via the various payment options available. Web The above tax rates apply to non-owner-occupied properties except for those in the exclusion list specified by IRAS.

Web 2 days agoSINGAPORE. Web How are property tax rates in Singapore calculated. Web Check Property Tax Balance This service enables you to enquire the property tax balance the payment mode of property in the Valuation List.

Web Singapores budget for 2023 presented 14 February 2023 includes the following proposed tax measuresfrom enhanced tax deduction schemes to progressive. Web What is property tax in Singapore. Web The final tax rates of up to 36 per cent for non-owner-occupied homes or 32 per cent for owner-occupied residential properties will take effect for tax payable from.

HDB households refuse collection fees will go up by S138 to S963 per month. Web 2 days agoFor residential properties the portion of the value of the property over S15 million and up to S3 million will be taxed at 5 per cent while the portion of the value in. Web 2 days agoThe property tax for owner-occupied residential properties was raised to 5 per cent to 23 per cent from 2023 and 6 per cent to 32 per cent from 2024 for the portion of.

These kinds of properties will continue to be tax at.

How Singapore Budget 2022 Impacts The Higher Net Worth Families Investment Moats

Budget 2022 Higher Taxes For Top Tier Earners High End Properties And Luxury Cars Cna

Singapore Tax Rates

Singapore Budget 2022 Highlights On Personal Finance Providend

Financing Of Property In Singapore Property Guides Noam Nathan

Higher Property Tax Next Year For Most Hdb Flat Owners Cna

Most Residential Properties To Incur Higher Tax From Jan 1 2023 Offset By One Off Tax Rebate Of Up To S 60 Today

New Property Tax Budget 2022

Budget 2022 Tax Rates For Residential Properties To Be Raised As Singapore Adjusts Wealth Taxes The Straits Times

Iras Why And When Does The Amount Change

Understanding Property Tax In Singapore Sg Luxury Condo

Iras What Is Property Tax

A Foreigner S Guide To Purchasing Property In Singapore Blogs And Market Trends Property Giant

Twitter এ Iras Here S A Reminder To Make Payment For Your Property Tax Bill By 31 Jan 2021 Need An Alternative Payment Plan Sign Up For Giro To Pay In Up To 12

Iras On Twitter Propertytax2022 Here S A Reminder To Make Payment For Your Property Tax Bill By 31 Jan 2022 Need An Alternative Payment Plan Sign Up For Giro To Pay In Up

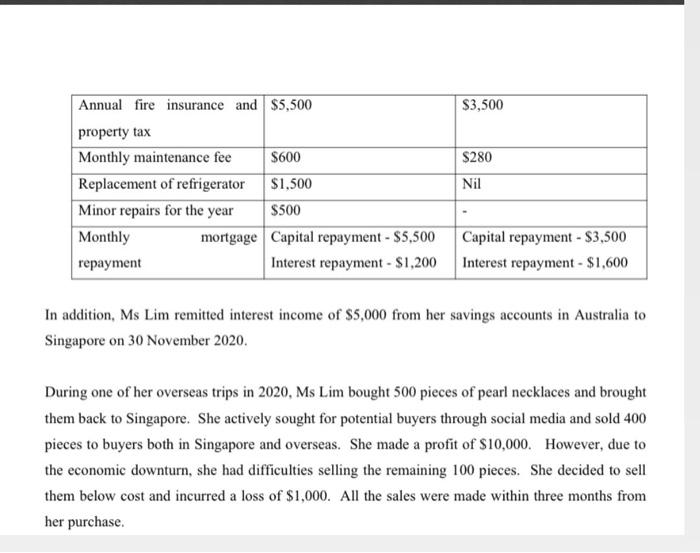

Solved Ms Amanda Lim Aged 45 Is A Singaporean Married With Chegg Com

Property Tax And Permanent Residence In Singapore